Introducing the DOVU staking programme

DOV is very much the core of our project but, over anything else, it represents more opportunities for expansion and governance, including the recent marketplace. Q4 was filled with discussions, ideas, and experiments that we’ve been running internally.

We’ve been working hard to ensure that DOVU’s home base for your offsetting platform will be on Hedera which means there’s a requirement for DOV tokens to be bridged.

Behind the scenes, we’ve been putting all the foundations in place for bridging capabilities – as well as an integration with one of our favourite wallets.

In January 2022 you’ll hear more about the direction we’re going in and why we use the tools that we do. The eagle-eyed among you have probably figured this out already, after all, in the Hedera ecosystem, many projects are interconnected.

So, once tokens have been bridged, what does this mean for a user?

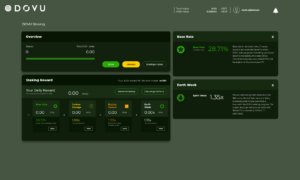

We’re proud to announce that in Q1 we’ll be releasing DOVU staking.

Staking explained

This will provide the capability for any user to earn DOV tokens that they can redeem on the marketplace for carbon offset-related needs. We developed this feature throughout the second half of 2021, from ideation to implementation.

In our research and development, we’ve taken a particular shine to a number of different staking platforms including Olympus Finance and WOO Network.

Matt, our CTO, has a particular fascination with incentivising users with high yield – but also with the ability to create a circular economy where a portion of token value continually replenishes staking pools. So, in the long-term, to create something that would enable participants to gain high yields for their carbon offsets, and offset even more that they could when they joined the pools. It would be economically viable without continually having to drain a core treasury.

Our staking vision

We want to incentivise any holder to reduce the velocity of external movements of a token. We also want to give them the opportunity to interact with the system, to increase yield over time that can be deployed back into the system as a utility.

Life after bridging

After bridging your DOV to Hedera, you’ll benefit from:

- A seamless and simple method to stake your position

- On-going auto-compounding of your token value for every staking reward, by default

- APY multipliers for duration of time, based on being inside of the ecosystem

- And, eventually, increased APY multiplies for utilising your earned DOV in the marketplace and on other services

Why does this matter?

This staking service will only utilise Hedera Hashgraph’s native services. You will always have full control and custody over the tokens that you own, coupled with the full speed and bandwidth of the network. You won’t risk losing tokens using DOVU’s staking platform.

What’s next?

In the coming weeks, we’re going to share more information about what we’re doing.

Matt notes, “There has been so much work done in the Ethereum space in terms of staking and farming. We want to take that knowledge and apply it to Hedera, build it from scratch and make it mind-meltingly amazing.”

Internally, we have been discussing a whole range of utilities and we have shared those ideations with the community. We will continue doing this as we go forward since it’s important to us that we add utilities that will genuinely benefit the network.

For those that bridge early, we’ll keep an eye on every single wallet that enters Hedera. We plan on making sure that those people are taken care of, believe in our mission, and where we’re going.

The future is bright.