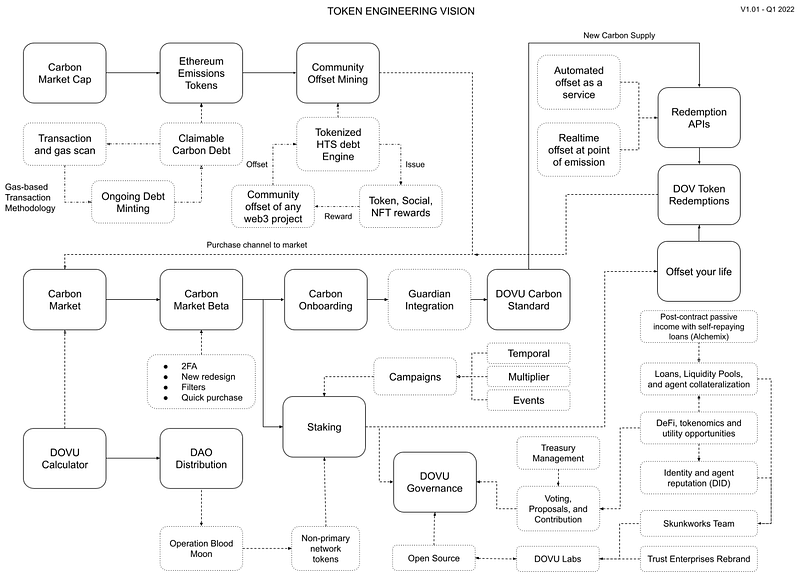

Token Engineering Vision #1: Carbon Market Cap

Welcome back to our token engineering vision series, which we’ve created to explore our vision via smaller and easy-to-digest elements.

Here, we explore incentive structure, sustainable economies and simulations.

In this post, we’ll focus on the Carbon Market Cap.

What is the Carbon Market Cap?

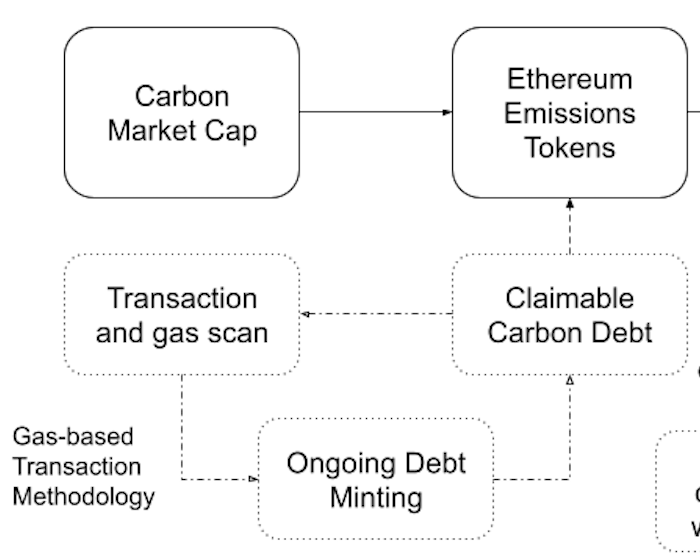

The Carbon Market Cap tracks the debt figures attached to Ethereum projects, focusing on the process of updating debt and token balance, while slowly venting them. It shows us why we need carbon debt and credits to be tokenised. Tokenisation gives companies and organisation the ability to carry their own debt. They can then shift these huge debt figures by turning carbon into emissions tokens.

The Carbon Market Cap is also very convenient, housing every project in one location. It’s a great way for users to understand the scale of the issue. The data in the Carbon Market Cap shows whether projects are carbon-neutral, and to what extent. It gives users the ability to see how they’re offsetting their carbon in real time. This makes it easier for anyone to understand how every active Ethereum project on the network is handling the ongoing carbon debt.

The Carbon Market Cap explores the question: how do we actually tie carbon debt to a company? This explores a new idea that is not connected to any price or speculation within the industry.

Of course, it’s a work in progress. But at DOVU, we’re already looking at creating a new form of staking that, previously, didn’t exist. This aims to examine the process of connecting tokenised carbon debt to a project and enabling that project to claim the debt and pay it down as a community.

Yield generation

Traditionally, there are two main ways to generate yield for tokens in staking:

- Single-sided staking: we recently released Phase 1 of our Staking Beta and will be opening Phase 2 soon.

- Liquidity mining: an individual provides a set of tokens into a pool. Usually, these tokens form a tokenised representation of liquidity in order to form a decentralised market.

In liquidity mining projects can deploy liquidity tokens (or LP) for higher yields. This is due to the higher risk, connected to a concept called impermanent loss (or IP). For both of these concepts, normally rewards are distributed through native tokens on a per project basis. DOVU has a liquidity pool in place, where anyone can contribute.

However, companies and projects have high carbon debts and pressure to meet ESG goals set through governance. Given the ongoing desire (and necessity) to move towards being more environmentally friendly, companies need to introduce new forms of community engagement. We think carbon offset staking could facilitate all these needs at the same time.

Ethereum debt growth

This means that companies with huge Ethereum debt figures could eventually grow into enterprises of the next generation — where ESG goals are a mainstay (as they are with the largest corporations in the world).

Rather than having to pay out a certain amount of carbon, communities can help companies meet these targets. In return, an organisation or company can provide value to the community, from social tokens to NFTs.

A bold vision

The concept of providing companies the ability to carry debt with them wherever they go and connecting this debt to the communities that companies have built over the years is unique. It would, critically, pave the way for organisations to do something about the increasing pressures of ESG demands.

Follow our socials to stay up to date with the latest from DOVU.

- Be the first in the know: https://discord.gg/wW7rg6dDN4

- Browse: https://dovu.earth/en/

- Connect: https://twitter.com/dovuofficial

- Read: https://medium.com/dovu-earth